Divvy Homes Rent to Own Program Qualifications

NOTE: As of July 2024, Divvy Homes has paused their acquisition activities until further notice.

Overview: Divvy Homes offers a straightforward rent-to-own process that enables potential buyers to select a home, rent it, and build up savings towards a down payment. Divvy provides flexible leasing terms and helps participants improve their credit scores over time.

Minimum Qualification Requirements for Divvy Homes

Here are the minimum qualification requirements we consider:

- A credit score of at least 550*: All applicants need to pass a soft credit check—this won’t affect your credit score. We’ll look at your credit score, recent loan delinquencies, and any foreclosures or bankruptcies**.

- In some cases, a soft credit check might not provide Divvy with enough information to determine your eligibility. If this happens, we’ll reach out and explain how to move forward.

- A minimum monthly income of $2,500: You can add a co-tenant during the application process. The exact minimum required income will depend on factors like your current debt levels and home prices in your desired metro area.

- 3 months of verifiable income: We look for 3 months of steady income. Keep in mind that self-employed income can take a little longer to verify. Learn more about our income documentation requirements here.

- Background check: We run a background check to determine your rental history and criminal background. For criminal background checks, we evaluate the recency and severity of any convictions. For rental history, no evictions should have occurred or been filed in the last 5 years.

- A valid government-issued photo ID

- Debt-to-income (DTI) ratio: We look at your debt-to-income ratio, which measures how much of your monthly income goes toward your monthly debt payments. You can calculate this by dividing your monthly debt payments (such as car, student loan, personal loan, rent, and minimum credit card payments) by your monthly income (before taxes). Learn more about DTI on our blog.

Categories

Recent Posts

Understanding Your Contract Deadlines in Georgia Real Estate

Why You Should Buy a Home in 2026: A Metro Atlanta Market Perspective

This May Be the Best Time To Buy a Brand-New Home

“No Payments Until Spring 2026? Here’s How Atlanta Buyers Can Benefit from This Rare Offer”

Top 5 Mistakes to Avoid When Buying or Selling Real Estate

The Return to Urban Living — Why More People Are Moving Back to Cities

Buying a Home May Help Shield You from Inflation

Moving in Together? 3 Money Talks to Have First

Seller Concessions: A Smart Strategy To Get Your House Sold

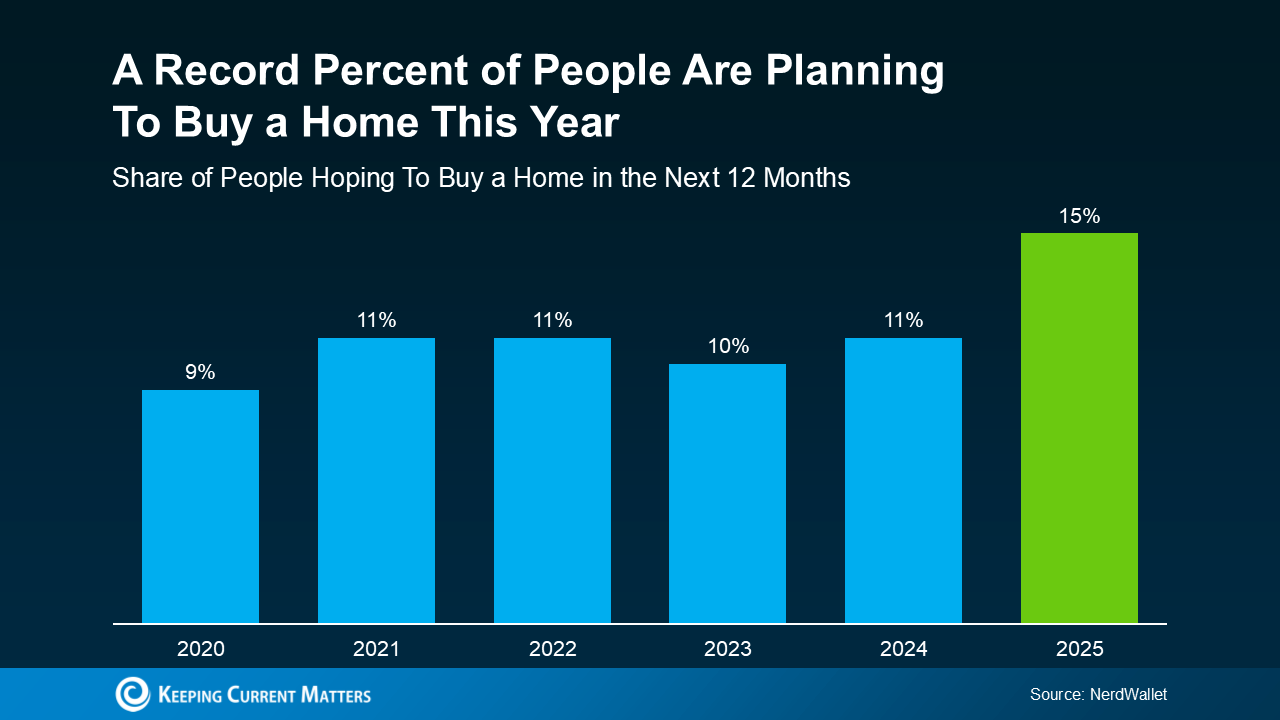

A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

Leave a reply