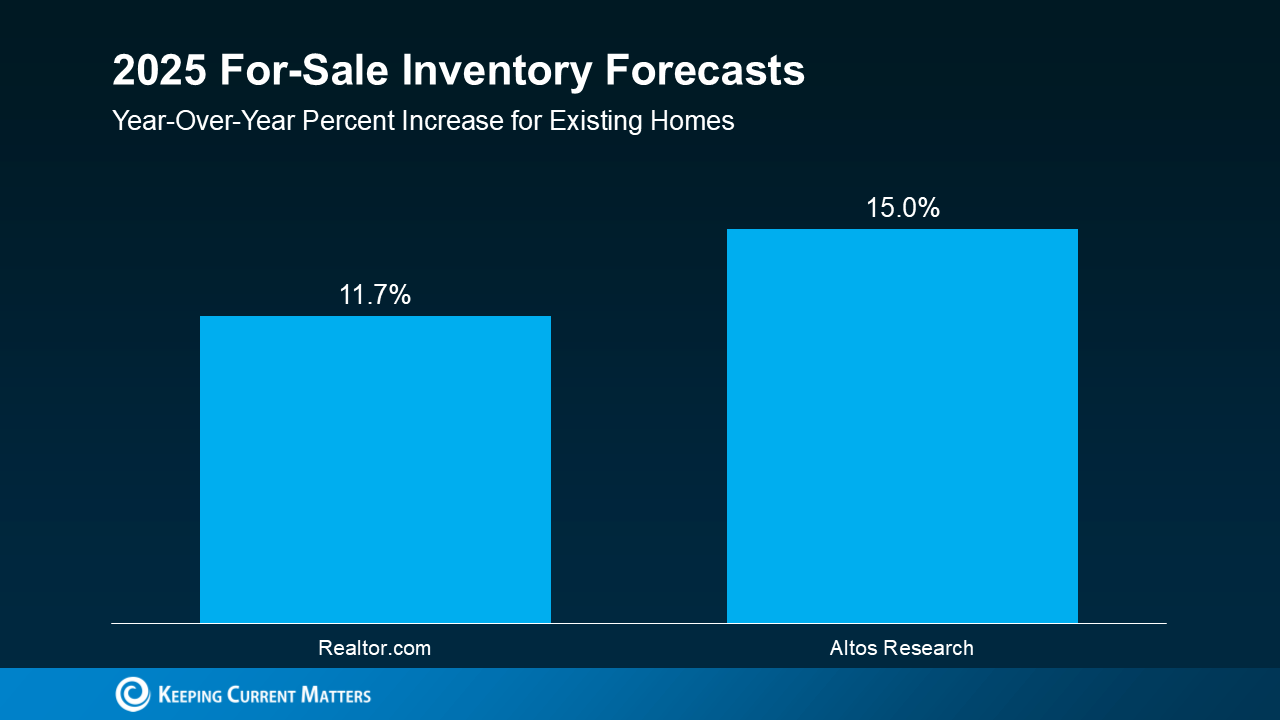

Buyer Bright Spot: There Are More Homes on the Market

The past few years have been challenging for homebuyers, especially with higher home prices and mortgage rates. And if you’re trying to buy a home, it’s easy to worry you won’t be able to find something in your budget. But here’s what you need to know. The number of homes for sale has grown a whole

Shaping the Future of Real Estate: Meet Terin Branhan

As the CEO and Qualifying Broker of Savvy Estates ATL, I am committed to empowering real estate professionals and ensuring seamless transactions for both agents and clients. At Savvy Estates ATL, we focus on fostering agent success through streamlined processes, compliance excellence, and innovative

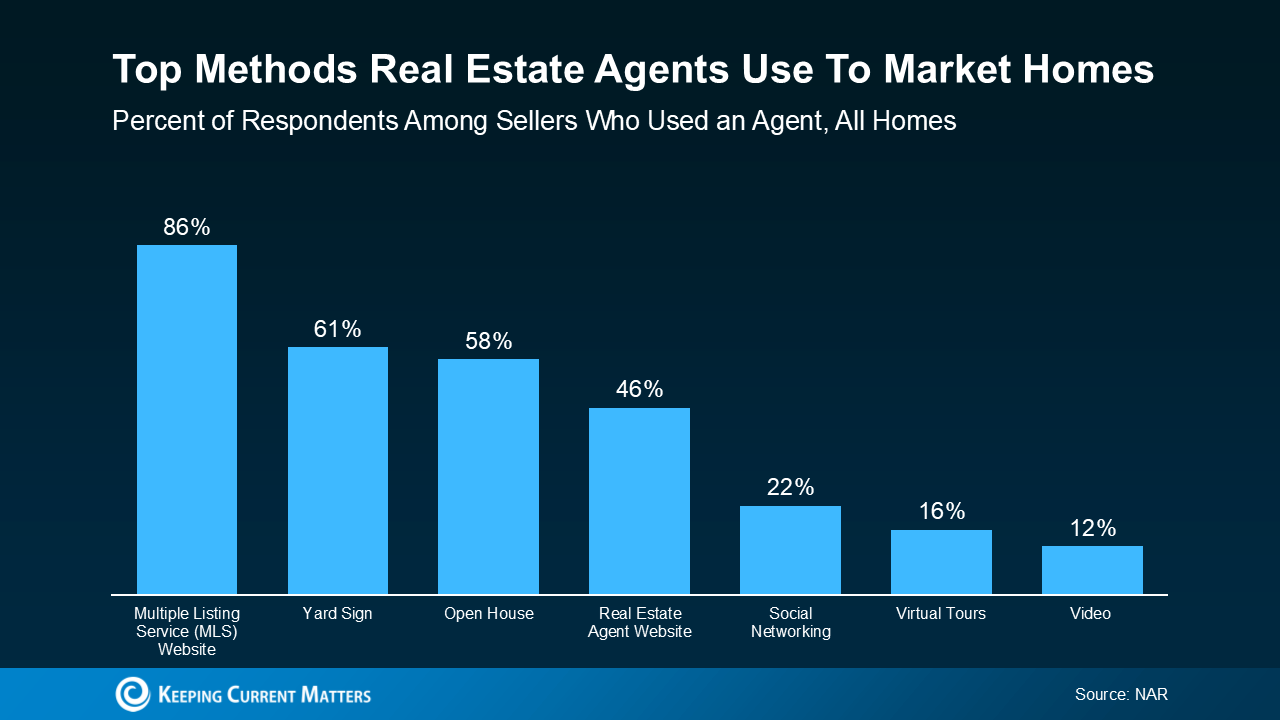

The Secret To Selling? Using an Agent To Get Your House Noticed

In a recent survey, the National Association of Realtors (NAR) asked sellers what they want most from a real estate agent. The number one answer was to help market their house. It makes sense. The way your agent markets your house can be the difference between whether or not it stands out and gets a

- 1

- ...

- 3

- 4

- 5

- 6

- 7

- ...

- 15

Categories

Recent Posts

Leave a reply